Why Invest in Art?

Australian art sales have increased by $30 million year on year (21-22) with almost 3 times the amount of volume passing through Australian auction houses according to the Financial Review. Additionally, contemporary art has demonstrated a price growth of 13.5% per annum compared to the S&P500 at just 10.2% (artindexau.com).

Contemporary Fine Art is being considered a serious asset for those who seek a diverse and comprehensive investment portfolio. In fact, 85% of Deloitte’s Wealth Managers agree that Fine Art is an essential part of wealth management strategy (Deloitte – Art & Finance Review 2021).

What some emerging buyers and collectors may overlook however that those adept at art acquisitions understand, is fine art tends to appreciate during periods of high inflation and general market instability (13.5% average increase), where more traditional investment streams, like the S&P500 and gold, do not perform as well (5.5% and 3.2% average growth respectively).

What does that mean for 19Karen?

In simple terms, as a gallery that represents artists at all stages of their career, it means that 19Karen affords collectors at all levels, opportunity to leverage the investment potential of contemporary art. Over the years 19Karen has represented a stable of emerging artists that have gone onto wider acclaim and seen significant gains in value, artists that other galleries were not willing to take on until at the commencement of their career before they had substantiated their position. But with over 30 years collecting experience and a honed eye for talent, in many cases, Director Terri Lew was the first to offer these artists representation.

Nonetheless, at the core of the 19Karen ethos remains the belief that the primary impetus for buying any piece of art should be joy. Buy art you love only then can you guarantee that your investment will yield a return for a lifetime.

Value Appreciation of 19Karen Represented Artists (sample)

| Artist | Years Represented | Increase in Value (avg) |

| Glendon Cordell | 2018 – current | 450% |

| Johnny Romeo | 2009 – current | 350% |

| Jisbar | 2017 – current | 450% |

| Guim Tio | 2010 – 2015 | 300% |

| Coco Davez | 2017 – 2019 | 800% |

| Okuda | 2014 – 2017 | 600% |

ARTIST: Glendon Cordell

PERIOD REPRESENTED by 19Karen: 2018 – current

ACHIEVEMENTS:

- Work currently sells for over 4 times the original value

- A piece of Cordell’s work recently sold at a Sotheby’s Auction for AUD 71,000

ARTIST: Johnny Romeo

PERIOD REPRESENTED by 19Karen: 2009 – current

ACHIEVEMENTS SINCE:

- Work currently sells for over three times the original value

- Critically acclaimed career artist with established collectorship throughout the world

- Hailed as Australia’s leading pop artist

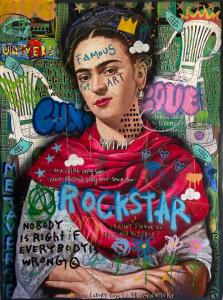

ARTIST: Jisbar

PERIOD REPRESENTED by 19Karen: 2017 – current

ACHIEVEMENTS SINCE:

- Work currently sells for over four times the original value

- Collaborations with BMW, Armani, LG and World MotoGP champion Fabio Quartararo

- An adept contemporary who was the first to send a painting to outer space

- Hand painted a handbag for Pop artist Cardi B

INSTANT ASSET WRITE-OFF

Running a business from home? Buy art for your home office and take advantage of the government’s immediate tax write-off rules*.

The instant asset write-off is currently available to businesses with turnover of less than $500 million.

IS ART INCLUDED?

Yes. Artworks are held to be depreciating assets by the ATO, which means that they qualify for the instant asset write-off measure.

During this financial year it is possible to claim a complete deduction of up to $20,000 for each artwork purchased by a small- or medium-sized business for their premises, subject to four criteria. The artwork must be:

– Tangible.

– Capable of being moved.

– Purchased predominantly for display in a business premise; and not be trading stock.

Please discuss with your accountant first to determine eligibility/suitability. In most cases, if your home is regarded as a “business premise” for tax purposes, then you can buy art and claim the instant write off deduction. In practice, what this means is that the art becomes an expense in the month that it is incurred and can be set off income for the month. In effect, it means that the money used to buy the art is not taxed.

For more information click here.